crypto tax accountant australia

Your guide to the best crypto tax software for. For your crypto assets you should keep records of.

Cryptocurrency Tax Accountant Inspire Ca

Top Crypto Tax Tools.

. Fill in the necessary information on your tax return and submit it. Mr Immanuel Shmuel was the owner director and authorised tax representative of a bank franchisee. Create a report on crypto activity using a crypto tax calculator like Crypto Tax Calculator Australia.

At Crypto Tax Calculator Australia we provide you with the ability and ease to do your crypto tax calculation here in Australia with our crypto tax app. Direct sync with the blockchain. Are you in need of a tax professional who specializes in bitcoin and cryptocurrencies.

Whether youre lodging your tax return yourself via myGov or working with an accountant - Koinly has a range of crypto tax reports for you. Is my accountant tax deductible. Tax Return Melbourne CBD Accountant Melbourne Melbourne Accountants.

Check out this directory of tax professionals. We provide accounting and tax return services from our office in Melbourne CBD. Learn more about Australian Crypto Tax.

Find out more details in this guide. Over a period of 2 years he failed to lodge business activity statements BAS. A former tax accountant and bank manager has been sentenced to 3 years jail for attempting to obtain a financial advantage of more than 390000.

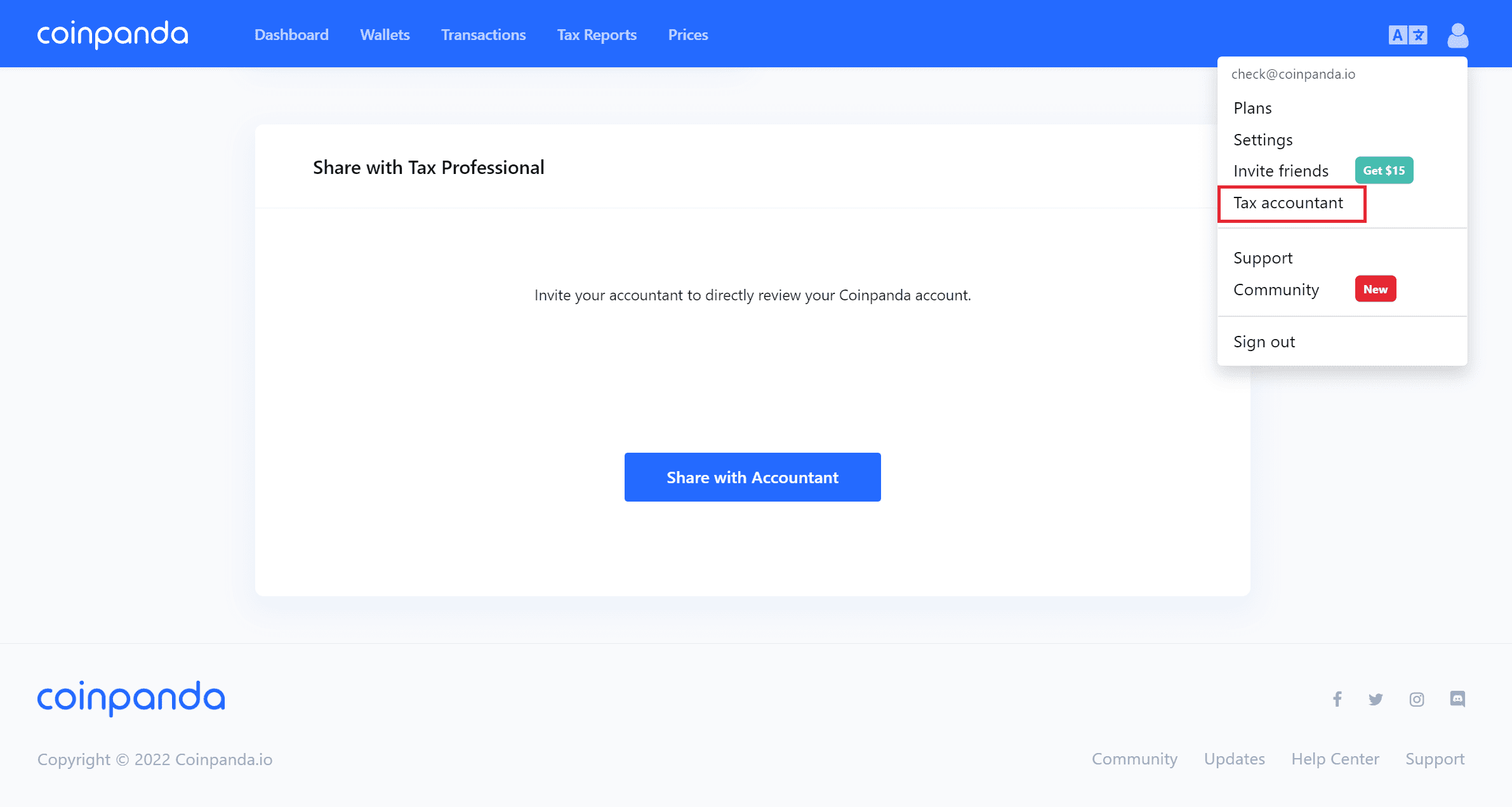

Solves Crypto Tax Specialist is a Chartered Accountant with 12 years experience in Big 4 tax consulting who advises crypto investors traders and businesses using Koinly. Download your capital gains report which shows all your short and long-term gains separately. Instantly share your data with your accountant.

Cant afford your crypto tax bill now the bear run has hit. Create a report of your crypto activity using a tax calculator like ours. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

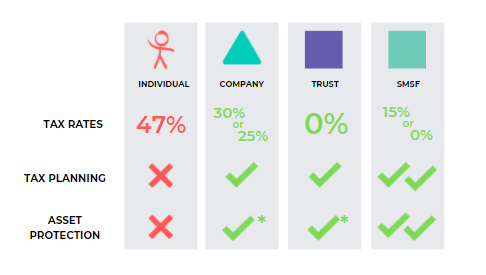

Digital wallet records and keys. You can search for a CPA or accountant in your area by clicking on the filter icon below for example to find a crypto accountant in your state. However its best to speak to a tax accountant who specialises in cryptocurrency for further advice.

Tax on crypto mining Canada. All the latest breaking UK and world news with in-depth comment and analysis pictures and videos from MailOnline and the Daily Mail. Enables you to share your data with crypto tax advisors.

Send the report to your accountant to complete your taxes. The official Crypto Tax Accountant directory. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Crypto Tax Calculator. Calculating your crypto tax is easier than you think. This is the directory of crypto accountants CPAs and tax professionals.

Tax rates 2021-2022 updated. If youre mining as a hobby you wont pay Income Tax on mined coins. Stop worrying about record keeping filing keeping up to date with the evolving crypto tax code.

Watch our Aussie Crypto Tax Guide here and on YouTube. Basically if you used crypto the Australian Tax Office ATO wants to know about it. Lets look at both.

Ethereum Solana and more. They use software to keep a record of all your trades so that you can easily convert them into AUD. You simply import all your transaction history and export your report.

Find a cheap tax agent or tax accountant. Calculating crypto taxes can be a delightful stress-free and fun way to spend a weekend Said nobody ever. 6 June 2022.

However manually preparing your transactions and books can be extremely time consuming and most. Designed Developed by Ratnesh Sharma Level 3 Suite 311343 Little Collins Street Melbourne VIC 3000. Four pricing plans 1 Free 2 Pro- 1099 per month 3 Expert 1699 per month 4 Unlimited- 5499 per month.

Its very accurate and simple to use. The return will take approximately two weeks to. Basic tax returns over the phone Australia-wide.

Receipts when you buy or transfer crypto assets. We always recommend you work with your accountanttax agent to review your records. We offer full support in US UK Canada Australia and partial support for every other country.

Records of agent accountant and legal costs. The CRA is clear that crypto mining tax varies depending on whether youre seen to be making business income or if youre a hobby miner. This change in work lifestyle may also impact how much tax refunds we will receive in Australia this year.

Sort out your crypto tax nightmare. Though our articles are for informational purposes only they are written in accordance with the latest guidelines from tax agencies around the world and reviewed by certified tax professionals before publication. Tax Professional Accountant packages Only supported blockchains.

Crypto tax laws for 100 countries. Integrate Koinlys crypto tax information with a third-party tax software or share the information with your personal accountant. In-person individual and business tax returns in Melbourne.

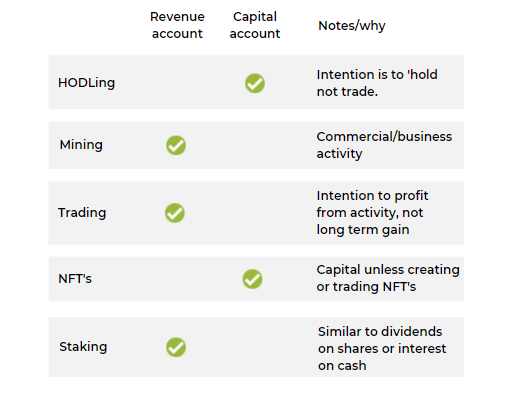

1 - 6 of 6. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. BitcoinTax is the most established crypto tax calculation service that can work out your capital gains and losses and produce the data and forms you need to file your taxes.

Seamlessly integrated with TurboTax and your accountants software. Or you may be eligible for an extension beyond this date if you are registered with a tax accountant by 31 st October. You simply import all your transaction history and export your report.

Let us do that for you. How is crypto tax calculated in Australia. Alternatively Swyftx partners with both Koinly and Crypto Tax Calculator who offer crypto tax reporting services to taxpayers in Australia.

You need to keep details for each crypto asset as they are separate CGT assets. Transactions include but are not limited to buying selling trading mining staking giving andor receiving cryptocurrency and this applies whether the transaction happened in Australia America or some nameless tax haven in the middle of the Pacific. Calculate tax years for US Canada Australia Germany United Kingdom or starting on 1st Jan.

Koinlys Ultimate Australia Crypto Tax Guide 2022. Guide updated for 2022. Our content is designed to educate the 300000 crypto investors who use the CoinLedger platform.

Suite 2641 Barratt Street Hurstville NSW 2220 Australia. You can also filter for CPAs attorneys tax preparers and advisers. I am afraid that for those of us not fortunate enough to live in one of the top crypto tax-friendly jurisdictions crypto taxes are just a part of life.

Software costs that relate to managing your tax affairs. The ATO issued a statement addressing crypto investors. Generate a full crypto tax report inclusive of all your.

Supports DeFi NFTs and decentralized exchanges.

Cryptocurrency Tax Accountant Inspire Ca

A T Tax Accounting Home Facebook

Tashapb I Will File Your Uk Company Accounts And Tax Return For 105 On Fiverr Com Tax Consulting Corporate Accounting Filing Taxes

When Do You Need A Crypto Accountant Koinly

A T Tax Accounting Home Facebook

The Accountants Guide Which Third Party Crypto Tax Tool Koinly

Income Tax Return E Filing E Filing Income Tax Returns Trutax Income Tax Return Tax Return Income Tax

Tax Tips On Bitcoin Crypto In Australia 2021 Specialist Cryptocurrency Tax Accountant Q A Youtube

Cryptocurrency Tax Accountant Inspire Ca

Crypto Tax Tips Australia 2021 Crypto Tax Accountant Q A Youtube

![]()

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

Business Loan Should You Or Not

Australian Tax Office Report Crypto Profits Or Else Internal Revenue Service Hr Block Investing In Cryptocurrency

The Future Of Accounting Demand And Evolving Technology

Australian Tax And Accounting Crypto Accountant In Australia Koinly